Table of Contents

- What is the I Fund?

- Recent TSP I Fund Returns

- The Impact of the Benchmark Shift

- Why Global Markets are Growing

- Comparing I Fund to Other Funds

- How Currency Affects Your Money

- Risks of Foreign Stocks

- Best Strategies for Federal Workers

- Final Thoughts for Investors

Federal workers want to grow their money. Many people look at the Thrift Savings Plan. Recently, TSP I Fund returns have been very strong. This fund now beats many other choices. However, you must know how it works first. This guide will show you the facts.

What is the I Fund?

The I Fund is for global stocks. It holds shares in firms outside the US. This fund gives you a way to spread risk. You can own parts of firms in Europe and Asia. Therefore, your wealth does not just stay in one place. Diversification is key for a safe retirement.

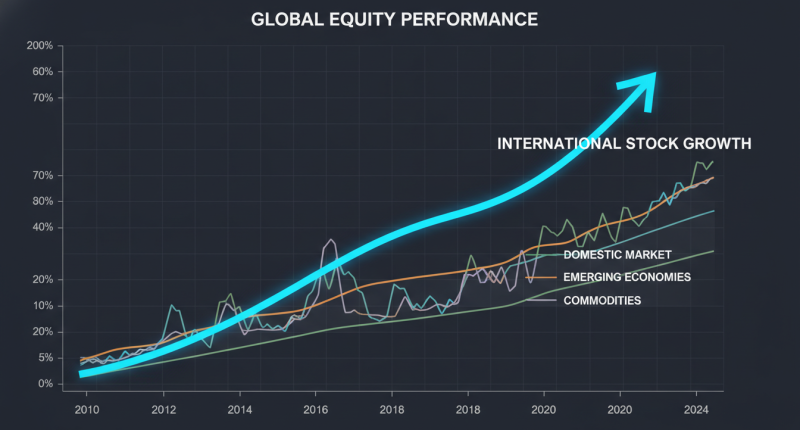

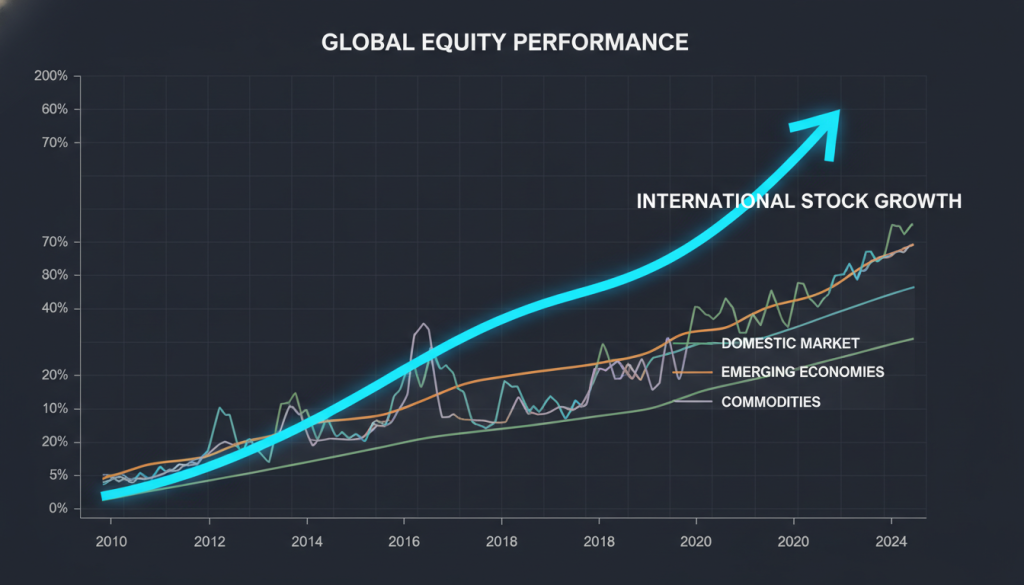

For many years, US stocks led the way. The C Fund grew very fast. But trends change over time. Now, other countries show high growth. Because of this, the I Fund is popular again. It helps you catch gains in foreign lands.

Recent TSP I Fund Returns

The latest data shows a big jump. TSP I Fund returns have stayed high this year. In fact, they outpace the G and F funds. Even the C Fund faces tough competition now. Consequently, many feds are moving their money. They want to ride this wave of growth.

Why is this happening now? Global trade is picking up. Many firms in Japan and France see more profit. Also, these stocks were cheap for a long time. Now, their value is going up fast. Thus, I Fund investors see great green bars on charts.

The Impact of the Benchmark Shift

The TSP board changed the index recently. This was a very big move. Before, the fund tracked fewer countries. Now, it tracks a much wider market. This includes more regions and more firms. Therefore, the fund is now more diverse than ever.

The new index helps capture more growth. It includes emerging markets in some cases. Consequently, the risk might change a bit. However, the reward can be much higher too. Most experts think this move was smart. It keeps the TSP modern and strong.

Why Global Markets are Growing

Europe is seeing a new boom. Firms there are very stable. In addition, Japan has a strong stock market now. Their tech and car firms do well. Because of this, the I Fund gains value. You win when these global giants win.

China and India also play a role. These markets grow very fast. Although they have risks, they offer big gains. The I Fund tracks these trends closely. Thus, you get a piece of the whole world. This helps you avoid US market dips.

Comparing I Fund to Other Funds

It is vital to compare your choices. The C Fund tracks the S&P 500. The S Fund tracks small US firms. Both are good, but they stay in the US. However, the I Fund goes abroad. This table shows how they differ in style.

| Fund Name | Asset Type | Risk Level | Primary Market |

|---|---|---|---|

| G Fund | US Bonds | Low | United States |

| F Fund | Fixed Income | Medium | United States |

| C Fund | Large Stocks | High | United States |

| S Fund | Small Stocks | High | United States |

| I Fund | Intl Stocks | High | International |

As you can see, the I Fund is unique. It is the only way to go global. Many people hold the C and I funds together. This mix covers the whole world. Therefore, you are ready for any market shift.

How Currency Affects Your Money

Currency prices change every day. The US Dollar might get weak. Or it might get very strong. This affects your TSP I Fund returns. When the dollar is weak, foreign stocks gain value. Consequently, your balance goes up even more.

But the reverse is also true. A strong dollar can hurt gains. However, this usually balances out over time. You should not fear currency shifts. They are a normal part of global trade. Just keep a long-term view for your goals.

Risks of Foreign Stocks

Every investment has some risk. Foreign stocks can be volatile. Political news can change prices fast. Also, some countries have less stable rules. Because of this, the I Fund can swing up and down. You must be ready for some bumps.

Do not put all your money in one spot. Use the L Funds for a safe mix. Or spread your picks across all funds. This way, one bad market won’t ruin you. In addition, keep some money in the G Fund. Safety is just as important as growth.

Best Strategies for Federal Workers

How should you invest today? First, look at your retirement date. If you are young, take more risk. Put more into the I and C funds. Then, let time do the work. Over many years, stocks usually win.

If you are near retirement, be careful. You might want more G Fund shares. However, keep some I Fund for growth. Inflation can eat your savings. You need growth to stay ahead of costs. Therefore, a small slice of international stocks helps.

Final Thoughts for Investors

The TSP I Fund returns are impressive now. They offer a great way to grow wealth. By going global, you find new paths to profit. But always stay informed on market changes. Check your balance once a month. This keeps you on the right track.

Talk to a pro if you feel lost. They can help with your specific plan. Remember, the TSP is a powerful tool. Use it well to reach your dreams. With the right mix, you will retire well. Stay steady and watch your money grow.