Table of Contents

- What are Social Security Benefits?

- How to Qualify for Benefits

- Earning Your Work Credits

- Choosing the Right Retirement Age

- The Cost of Early Claiming

- Benefits of Waiting Until Age 70

- Understanding Spousal Benefits

- Survivor Benefits for Your Family

- Rules for Divorced Spouses

- Taxes on Social Security Benefits

- Working While You Get Benefits

- SSDI and SSI Explained

- Benefit Comparison Table

- Cost of Living Adjustments

- How to Apply Online

- Common Mistakes to Avoid

- Social Security FAQ Summary

What are Social Security Benefits?

Social Security Benefits provide a steady income for retirees. This program helps millions of Americans every month. However, many people find the rules hard to learn. Therefore, you must plan your strategy early. Because of this, you will have a better life later. First, you should know that this is a federal program. Consequently, the rules apply to all fifty states. Also, the money comes from your payroll taxes. Thus, you are paying for your own future pay.

How to Qualify for Benefits

You must work for a set time to qualify. Specifically, you need to earn enough credits. However, you can only earn four credits each year. Most workers need forty credits in total. Therefore, ten years of work is usually the rule. In addition, you must pay into the system during this time. Because you work, you gain these vital rights. Consequently, your history is kept by the government. If you lack credits, you might not get pay. However, some family rules may still help you.

Earning Your Work Credits

Credits are based on your total yearly pay. However, the amount needed for a credit changes. Each year, the cost of one credit goes up slightly. Therefore, you should check your yearly statement. Also, you can see your record on the web. Because you track this, you avoid bad errors. In addition, you can fix mistakes on your record. Consequently, your final check will be correct. Moreover, this helps you plan your exit from work. Thus, stay informed about your earnings.

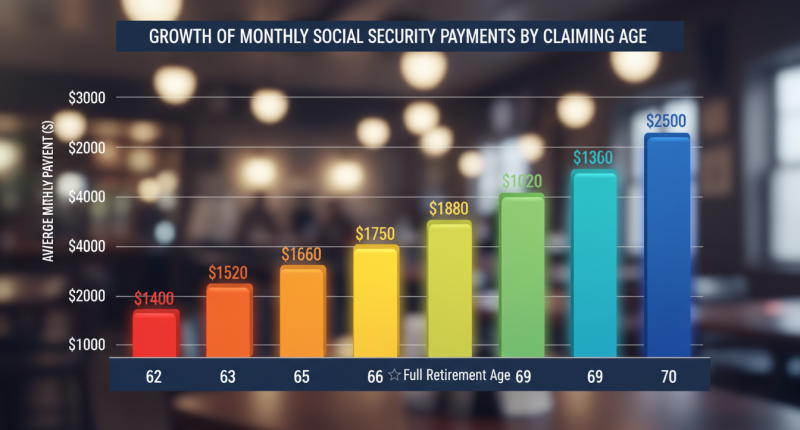

Choosing the Right Retirement Age

The age you pick changes your monthly check. However, you can start as early as age sixty-two. But this choice will lower your pay for life. Therefore, many experts suggest waiting longer. Your full retirement age depends on your birth year. For example, it is age sixty-seven for most now. Consequently, waiting for this age gives you full pay. Also, it ensures your spouse gets more later. Thus, the timing is a major choice for you.

The Cost of Early Claiming

Claiming early can be a costly mistake. For instance, your check could drop by thirty percent. However, some people need the money right away. Therefore, they take the lower pay. But you should look at other options first. Because the cut is permanent, it lasts forever. Consequently, you might struggle when you are older. Also, it reduces the base for future raises. Thus, think deeply before you file at sixty-two.

Benefits of Waiting Until Age 70

Waiting until age seventy is a smart move for many. Specifically, your pay grows by eight percent each year. This growth happens after your full retirement age. Therefore, your check can be much larger. Because of this, you gain more safety from inflation. In addition, your lifetime total pay often goes up. Consequently, this is the best way to maximize pay. Also, it protects a surviving spouse. Thus, try to wait if you are healthy.

Understanding Spousal Benefits

You can get pay based on your spouse’s work. Specifically, you can get up to half of their pay. However, you must be at least sixty-two years old. Also, your spouse must have filed for their own pay. Therefore, you must coordinate your filing dates. If your own pay is higher, you get that. Consequently, the system gives you the best amount. Moreover, this helps stay-at-home parents greatly. Thus, check both records before you file.

Survivor Benefits for Your Family

Social Security Benefits help families after a death. For example, a widow can get the full check. However, there are strict age rules for this. Also, children can get pay if a parent dies. Therefore, this acts as a form of life insurance. Because of this, your family has a safety net. Consequently, you should keep your records safe. Moreover, tell your family about these rights. Thus, they will know what to do later.

Rules for Divorced Spouses

Divorced people can still get pay from an ex-spouse. However, the marriage must have lasted ten years. Also, you must be currently single to qualify. Therefore, your ex-spouse’s work can still help you. Because of this rule, many find extra money. Consequently, your ex does not need to know. In addition, it does not hurt their own pay. Thus, look into this if you were wed long.

Taxes on Social Security Benefits

Some people must pay taxes on their checks. Specifically, this depends on your total income. However, low-income people often pay no tax. Therefore, you should calculate your combined income. Because of this, you might owe the IRS. Consequently, you can ask to have taxes taken out. Also, states have different tax rules for this. Thus, check with a tax pro near you.

Working While You Get Benefits

You can work and get pay at the same time. However, there are earnings limits before full retirement. Specifically, the government may hold back some pay. Therefore, you should watch your hours closely. But you get this money back later. Because of this, working is still a good idea. Consequently, your monthly pay will rise at age sixty-seven. Also, your new work can boost your record. Thus, keep track of your yearly earnings.

SSDI and SSI Explained

The system also helps those who cannot work. First, SSDI is for people with a work history. However, you must have a severe medical condition. Therefore, the process to apply can take time. In addition, SSI helps people with very low income. Because SSI is based on need, work history matters less. Consequently, these programs prevent extreme poverty. Also, you may get health care with these. Thus, apply if you become unable to work.

Benefit Comparison Table

Below is a table showing how age affects pay. Use this to plan your retirement date. Consequently, you will see the value of waiting.

| Age at Claim | Percent of Full Benefit | Monthly Total (Example) |

|---|---|---|

| 62 | 70% | $1,400 |

| 65 | 86.7% | $1,734 |

| 67 | 100% | $2,000 |

| 70 | 124% | $2,480 |

Cost of Living Adjustments

Benefits usually go up each year. Specifically, this is called a COLA adjustment. However, the amount is based on inflation data. Therefore, your pay keeps up with rising costs. Because of this, you can afford food and rent. Consequently, retirees feel more secure over time. Also, this happens automatically every January. Thus, you do not need to ask for it. Moreover, it protects your buying power for life.

How to Apply Online

Applying online is the fastest way to get pay. First, go to the official Social Security site. However, you should apply three months early. Therefore, you will get your first check on time. Because the site is secure, your data is safe. In addition, you can save your progress as you go. Consequently, you do not have to visit an office. Also, you can track your status via the web. Thus, start your claim when you are ready.

Common Mistakes to Avoid

Many people make simple errors when filing. For example, they claim too early without a plan. However, you can change your mind for one year. Also, forgetting about taxes can cause big stress. Therefore, you should talk to a planner first. Because mistakes are hard to fix, take your time. In addition, check your work record every year. Consequently, you will catch errors before you retire. Thus, stay active in your fiscal planning.

“Social Security Benefits are more than a check. They are a promise made to every worker.”

Social Security FAQ Summary

In summary, Social Security Benefits are vital for your future. However, you must understand the rules to win. Therefore, use this guide as a starting point. Because you have the facts, you can act now. Also, remember to check for yearly COLA raises. Consequently, your retirement will be much brighter. Moreover, help your family learn these rules too. Thus, everyone can have a safe financial life. Finally, always consult the official site for new changes.