Table of Contents

- Introduction to Investing Options

- What are ETFs?

- The Role of a Financial Advisor

- Comparison of Fees

- How Fees Eat Your Wealth

- Pros and Cons of ETFs

- Pros and Cons of Advisors

- The Robo-Advisor Middle Path

- Tax Factors and Efficiency

- The Final Verdict

Introduction to Investing Options

Many people look at ETFs vs Financial Advisors when they start. This choice can change your life. It affects how much money you keep. However, you must know the facts first.

Investing can be hard to learn. Therefore, many people pay for help. But fees can be very high. This guide will show you the best path. We will look at costs and growth.

What are ETFs?

ETFs are Exchange Traded Funds. They hold many stocks or bonds. You buy them like a single stock. Consequently, they give you instant balance. They are easy to buy and sell.

Most ETFs follow a big index. For example, they follow the S&P 500. This means they match the market. Because of this, they have very low costs. Many ETFs cost almost nothing to own.

In addition, ETFs are very clear. You can see what you own every day. This helps you feel safe. Most investors love this part. They want to know where their money goes.

The Role of a Financial Advisor

A financial advisor is a person. They help you make a plan. First, they look at your goals. Then, they pick assets for you. They offer a human touch.

Advisors can help with big life moves. For instance, they help with home buys. They also help with tax planning. However, they are not free. Most charge a part of your total wealth.

Many people like having a partner. It gives them peace of mind. But you must ask if it is worth it. Sometimes, the cost is too high. We will check the numbers next.

Comparison of Fees

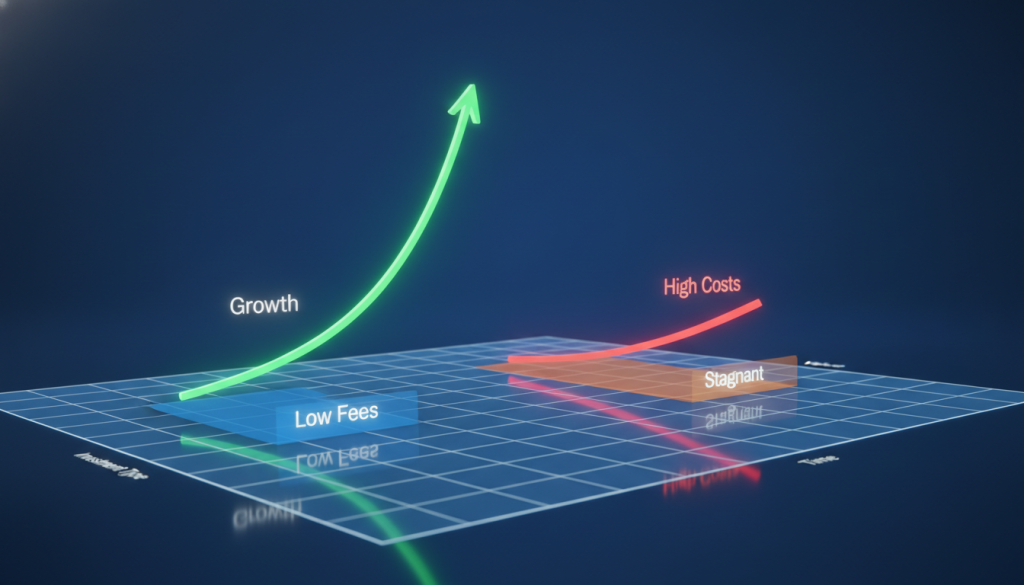

Fees are a big deal in finance. Even a small fee adds up fast. Therefore, you must compare them now. Here is a look at the costs.

| Feature | ETF Portfolio | Financial Advisor |

|---|---|---|

| Annual Fee | 0.03% – 0.20% | 1.00% – 1.50% |

| Trading Costs | Zero to Low | Varies |

| Management Style | Passive | Active or Guided |

| Human Advice | None | Full Support |

As you see, ETFs are much cheaper. Advisors cost ten times more or more. Consequently, this affects your total returns. You must think about this gap.

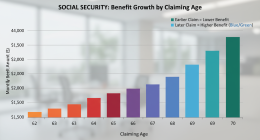

How Fees Eat Your Wealth

Fees act like a slow leak. At first, you may not see it. However, time makes the leak bigger. Because of compound growth, you lose a lot. This is a huge risk.

Imagine you have one million dollars. A 1% fee is ten thousand dollars. That is just for one year. Over thirty years, you lose a fortune. Therefore, low fees are key to wealth.

In addition, the market is not sure. But fees are always sure. You pay them even if you lose money. Consequently, low-cost ETFs often win the race.

Pros and Cons of ETFs

ETFs have many good points. First, they are very cheap. Second, they are very diverse. You own hundreds of firms at once. This lowers your risk.

However, there are some bad points. You must do the work yourself. You have to pick the right funds. Also, you must stay calm. If the market drops, you might panic.

Most ETFs are passive. They do not try to beat the market. They just match it. But matching the market is often great. Most active pros fail to beat it.

Pros and Cons of Advisors

Advisors offer help when things get tough. For example, they stop you from selling. This can save you from big losses. Therefore, they have real value.

But the cost is a major con. In addition, not all advisors are good. Some just want to sell products. You must find a fiduciary. They must put you first.

If you have a complex life, get help. For instance, if you own a firm. Or if you have many heirs. In those cases, a pro is good. But for most, ETFs work better.

The Robo-Advisor Middle Path

Robo-advisors use computer code to invest. They offer a middle path. They use ETFs to build portfolios. Consequently, they are cheaper than humans.

They charge about 0.25% per year. This is more than plain ETFs. But it is less than a person. Therefore, it is a smart choice for many.

Robos do the work for you. They rebalance your stocks. They also help with taxes. Because of this, they are very popular now. They make investing very easy.

Tax Factors and Efficiency

Taxes can hurt your total gains. ETFs are very tax-efficient. This is because of how they work. They do not sell often. Therefore, you pay fewer taxes.

Advisors also help with tax loss. This is called tax-loss harvesting. It can save you money. However, robos do this too. You do not need a person for it.

Always check your tax bracket. If it is high, be careful. Low turnover is your friend. ETFs excel at this task. Consequently, you keep more of your profit.

The Final Verdict

So, which is best for you? For most, ETFs win the fight. They are cheap and effective. Therefore, they build more wealth over time. You keep your own money.

However, some need a human touch. If you have millions, get a pro. Just ensure they are worth the cost. Always check their fees first. This is your future.

In conclusion, focus on the focusKeyword. Use ETFs for the core of your plan. Then, add help only if you must. This path leads to the best results. Start your journey today.