Table of Contents

- The Big Choice: ETFs vs Financial Advisers

- The Hidden Trap of High Fees

- Why ETFs Are Winning the Race

- What Financial Advisers Really Offer

- The Math: Fees Over Thirty Years

- The Magic of Compound Interest

- Tax Perks of Doing It Yourself

- Why Most People Fail Alone

- Robo-Advisers: A Middle Path

- Making Your Final Choice

The Big Choice: ETFs vs Financial Advisers

Choosing between ETFs vs Financial Advisers is a big step. This choice affects your long-term wealth. Many people want to save money. They want their cash to grow fast. However, high fees can slow you down. In contrast, ETFs offer a cheap path. But can you manage a portfolio alone? This guide explores both paths. We will look at costs. We will look at returns. Finally, we will help you decide.

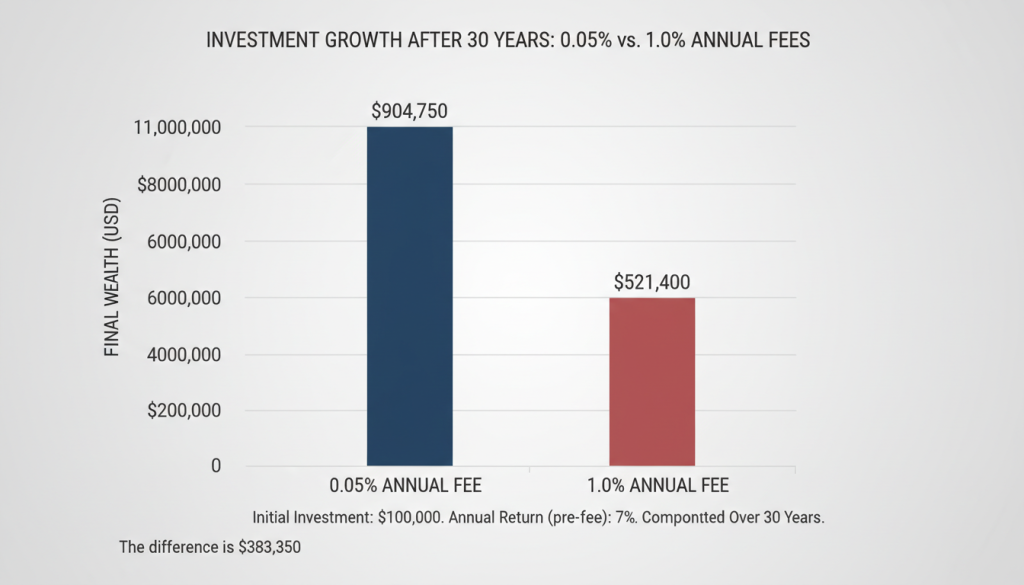

The Hidden Trap of High Fees

Fees act like a slow leak. A small leak sinks a big ship. In finance, this is very true. Most pros charge about one percent. This fee seems small at first. However, it applies to all your money. It is not just on your gains. Therefore, the cost adds up fast. Over time, you pay a lot. This money could have stayed in your account. Consequently, your total wealth stays lower. You must watch every cent.

How Costs Eat Your Gains

Let us look at a small example. You have one hundred thousand dollars. Your pro takes one percent each year. That is one thousand dollars. But your money grows every year. Next year, the fee is higher. Consequently, the loss grows too. In thirty years, this is huge. You might lose one-third of your total. This is why low costs matter. It is your hard-earned cash.

Why ETFs Are Winning the Race

ETFs are very popular now. This is because they are cheap. Many funds cost almost nothing. Some charge point zero three percent. This is much less than a pro. In addition, ETFs track the whole market. You buy a piece of everything. This lowers your risk. You do not rely on one person. Instead, you rely on the whole economy. History shows this works well.

The Variety of Fund Choices

There are many types of ETFs. You can buy the total stock market. Also, you can buy bonds. Some funds focus on tech. Others focus on green energy. This variety helps you build a plan. You can pick what fits you. Plus, you can change it any time. You have full control of your path. This is a great perk.

What Financial Advisers Really Offer

Advisers do more than pick stocks. They offer a full plan. For example, they help with taxes. They also help with estate plans. Some people feel scared of the market. A pro keeps them calm. When stocks fall, pros say stay. This stops you from selling low. Therefore, they add value through coaching. This is hard to do alone. Is that coaching worth the fee? That is the big question.

“Fees are the only thing you can control in the market. Every dollar you save in fees is a dollar in your pocket.”

The Math: Fees Over Thirty Years

Let us compare the two paths. We will look at a long timeline. This shows the true cost of advice. First, we look at a cheap ETF. Next, we look at a standard adviser. The gap will surprise you.

| Feature | ETF Portfolio | Financial Adviser |

|---|---|---|

| Annual Fee | 0.05% | 1.00% |

| Cost on $1M | $500 | $10,000 |

| 30-Year Loss | $45,000 | $580,000 |

| Total Control | High | Low |

| Personal Plan | Manual | Included |

The Magic of Compound Interest

Compound interest is a strong force. It makes money grow like a tree. But fees act like a saw. They cut the branches every year. This stops the tree from reaching the sky. Consequently, the loss is not linear. It is exponential. Every dollar lost to fees is lost forever. It never gets to grow again. This is the main math problem. Therefore, keeping fees low is vital.

Tax Perks of Doing It Yourself

ETFs are very tax-efficient. This is because they trade less. Low trade counts mean low tax. In contrast, some pros trade a lot. This creates tax bills for you. Even if you make no money. Consequently, your net return drops. You must look at what you keep. Taxes can be a huge drag. ETFs help you keep more. This is a key win for DIY.

Harvesting Your Losses

You can also use tax loss harvesting. This means you sell losing stocks. You use the loss to lower tax. Pros do this for you. But you can do it too. Many tools help you now. It takes just a few clicks. Consequently, you save on your bill. This adds to your total return. It is a smart move.

Why Most People Fail Alone

Managing money is hard for the mind. We feel fear and greed. When stocks crash, we want to run. This is a big mistake. A pro acts as a shield. They talk you out of bad moves. This is the behavioral gap. Many DIY folks buy high. Then, they sell low. Consequently, they lose more than the fees. You must have an iron will. If you do, you win.

Robo-Advisers: A Middle Path

Maybe you want help but no high fees. Robo-advisers are the answer. These are apps that use math. They pick ETFs for you. They cost about point two five percent. This is cheaper than a human pro. However, it gives you a plan. It rebalances your assets too. Consequently, it is a good middle ground. Many young people pick this path. It is easy and low cost.

Making Your Final Choice

In the end, the choice is yours. ETFs vs Financial Advisers is a personal trade. If you like math, pick ETFs. You will save a fortune in fees. If you feel scared, get a pro. A pro can stop big mistakes. But you must know the cost. One percent is a lot of money. It will eat your returns. Therefore, be sure the value is there. Your future self will thank you. Start small and keep learning. Your wealth is in your hands.