Table of Contents

- Understanding Social Security Benefits

- How COLA Impacts Your Check

- Choosing the Best Filing Age

- Benefit Comparison Table

- Inflation and Your Retirement

- Working While Receiving Pay

- Taxation on Monthly Checks

- Spousal and Survivor Rules

- The Future of the Program

- Steps to Boost Your Pay

Understanding Social Security Benefits

Social Security benefits provide vital income for millions of retired workers. These monthly payments help you cover basic costs like food and housing. Because prices rise, you must know how the system works. This guide will show you how to get the most money.

The system relies on your lifetime earnings. Therefore, the more you earn, the more you may receive later. However, there are limits on these amounts. Thus, you need a smart plan for your golden years.

First, you must work for at least ten years. This allows you to earn enough credits. Consequently, the Social Security Administration can then calculate your base pay. This base pay stays with you for life.

How COLA Impacts Your Check

COLA stands for Cost-of-Living Adjustment. The SSA uses it to keep up with high prices. Each year, they review the cost of goods. If prices go up, your checks will also grow.

For example, the COLA in 2024 helped many seniors stay afloat. However, the 2025 shift might be smaller than some hope. Because inflation changes, the SSA must adjust the math. You should watch for these news updates every October.

Additionally, COLA protects the buying power of your dollar. Without it, your fixed income would buy less over time. Therefore, it is a key part of the federal program. Indeed, it is a safety net for all retirees.

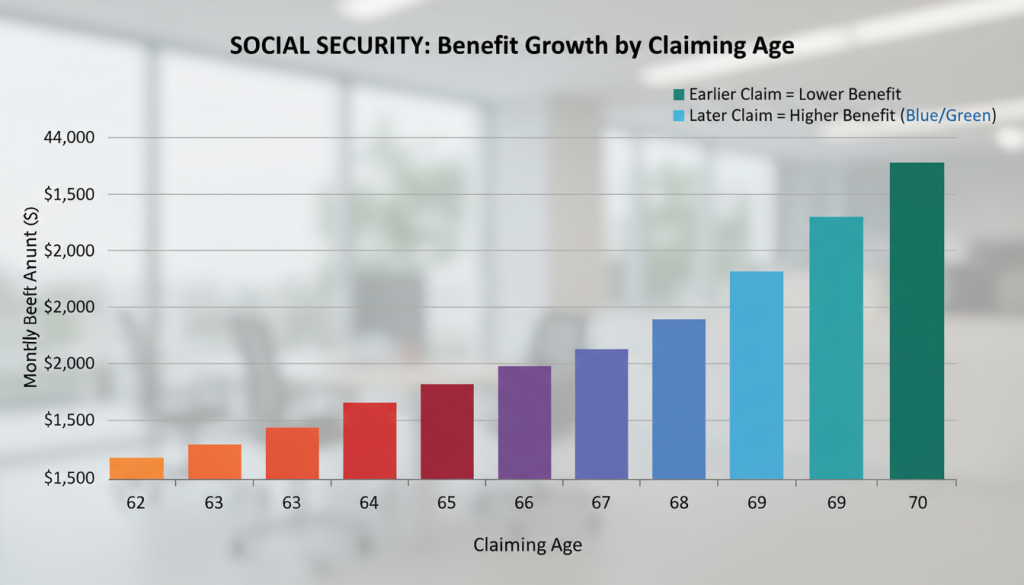

Choosing the Best Filing Age

You can start your checks at age 62. But, your monthly pay will be much lower. If you wait until age 70, you get much more. Specifically, your check grows by 8% each year you delay.

Many people take the money early because they need it. Yet, waiting until age 67 gives you the full amount. This age is your Full Retirement Age. You should check your own birth year to find your age.

Consequently, filing age is the biggest factor you can control. A worker at 70 gets much more than a worker at 62. Thus, you must weigh your health and your savings carefully. If you live long, waiting is usually best.

Benefit Comparison Table

This table shows how filing age affects your monthly Social Security benefits. These figures are based on a standard $2,000 full benefit amount.

| Filing Age | Monthly Pay | Total of Full Pay |

|---|---|---|

| Age 62 | $1,400 | 70% |

| Age 67 | $2,000 | 100% |

| Age 70 | $2,480 | 124% |

Inflation and Your Retirement

Inflation is a major risk for seniors on a budget. When gas and food prices spike, your budget feels the pinch. Therefore, Social Security benefits must rise to help you. However, the rise often lags behind real costs.

Because medical costs rise fast, COLA may not cover everything. Consequently, you should have other savings as well. An IRA or a 401k can provide extra support. Plus, these tools help you manage high tax rates later.

Likewise, keep an eye on the CPI-W index. This index tracks what workers pay for basic items. The SSA uses this data to set the COLA each year. Thus, it directly affects your bank account every January.

Working While Receiving Pay

Can you work and get Social Security benefits at the same time? Yes, you can. But, there are rules if you are under full retirement age. If you earn too much, the SSA holds some pay.

For example, you might lose $1 for every $2 you earn. This happens once you cross the yearly limit. However, you get this money back once you reach age 67. Therefore, the money is not truly lost forever.

Instead, the SSA recalculates your check to be higher later. Still, it can be a shock to your monthly budget. Consequently, you should plan your work hours carefully. If you are over 67, no earnings limit applies.

Taxation on Monthly Checks

Many seniors are surprised to find they owe taxes on benefits. This happens if your total income is above a set level. Specifically, up to 85% of your pay can be taxed. Because of this, you must track your total income.

Total income includes half of your Social Security benefits plus other pay. If you are single and earn over $25,000, you might pay. For couples, the limit is $32,000. Thus, many middle-class seniors owe the IRS.

You can choose to have taxes taken out of your check. This prevents a big bill at the end of the year. Additionally, it helps you manage your cash flow. Speak with a pro to see what fits you.

Spousal and Survivor Rules

Married couples have more options for Social Security benefits. You can claim a check based on your own work record. Or, you can claim half of your spouse’s full amount. The SSA gives you whichever is higher.

Moreover, survivor benefits protect you if a spouse passes away. In that case, you can receive their full monthly amount. This is a vital shield for many widows and widowers. But, you must be at least age 60 to claim.

Consequently, planning as a couple is very important. Usually, the high earner should wait until 70 to file. This ensures the survivor gets the biggest possible check later. Indeed, it is a smart way to protect your family.

The Future of the Program

Will Social Security benefits be there for you? This is a common worry for young and old. The trust funds currently face a gap in the future. However, the program will likely not disappear entirely.

Congress has the power to fix the funding issues. They could raise the wage cap or change the tax rate. Therefore, many experts think the system will survive. Even if the fund is low, tax money still flows in.

Consequently, you should stay calm about the news. Focus on what you can control today. For instance, save more in your private accounts. Thus, you will be ready for any future shifts.

Steps to Boost Your Pay

First, check your earnings record on the SSA website. Ensure every year of work is listed correctly. If there is an error, your pay will be lower. Therefore, fixing mistakes is a top priority.

Second, try to work for at least 35 years. The SSA uses your top 35 years to find your pay. If you work less, they put in zeros. This lowers your average and your final check.

Finally, wait as long as possible before you file. Every month you wait adds a small boost. Over several years, this adds up to hundreds of dollars. Consequently, patience pays off in a very big way.