Table of Contents

- Introduction to US Bank Earnings

- JPMorgan Chase Performance Analysis

- Wells Fargo Financial Results

- Citigroup Strategic Transformation

- Net Interest Income Trends

- Investment Banking Recovery Status

- State of the American Consumer

- Bank Performance Comparison Table

- Future Outlook and Risks

- Final Summary of Banking Trends

Introduction to US Bank Earnings

US bank earnings offer a clear view of the global economy. Currently, investors watch these reports with great care. This is because banks show how businesses and people spend money. Therefore, these results impact the entire stock market. Major lenders like JPMorgan Chase recently shared their gains. However, some results vary across the sector. Specifically, higher interest rates create both wins and losses. Consequently, analysts study every detail of these reports. We will explore the latest trends in this sector today.

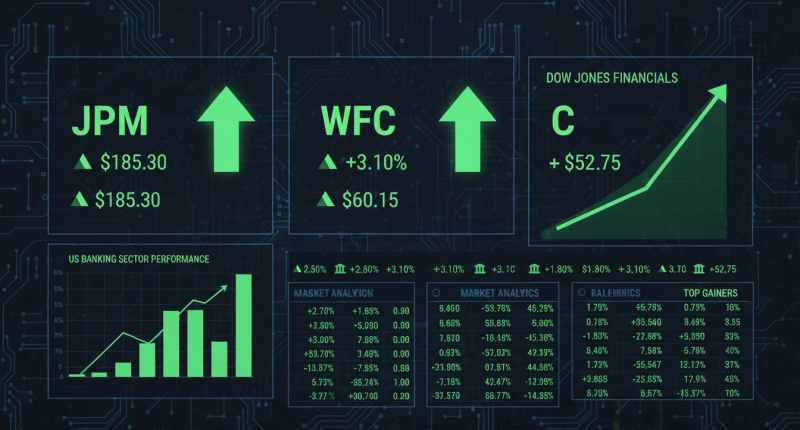

JPMorgan Chase Performance Analysis

JPMorgan Chase remains a leader in the financial world. Recently, its US bank earnings reached record levels. Because the bank is so large, it handles many types of loans. For instance, its retail unit saw high activity. Moreover, the bank gained from higher interest rates. This helped their net interest income grow. However, management warned about future costs. They expect higher expenses later this year. Consequently, they stay cautious about the economic path. Therefore, they keep large cash reserves. This helps them stay safe during market shifts. Besides, Jamie Dimon noted that inflation might persist. As a result, the bank prepares for various scenarios.

The investment banking wing also saw a boost. Specifically, deal-making started to pick up again. Consequently, fees from mergers and acquisitions rose. This is good news for the industry. However, the bank faces more rules from regulators. These rules might limit how much they can lend. Nevertheless, JPMorgan continues to outpace most competitors. They use their size to win more market share. In addition, their digital tools attract many young customers. This ensures growth for many years to come.

Wells Fargo Financial Results

Wells Fargo showed steady progress in its latest reports. The bank focuses mainly on domestic lending in the US. Therefore, its US bank earnings reflect local economic health. Because rates stayed high, their lending profits remained strong. However, they face a cap on their total assets. This cap comes from past regulatory issues. Consequently, the bank must focus on efficiency. They aim to cut costs to boost their bottom line. For example, they closed some older branches recently. As a result, their profit margins improved. Moreover, the bank sees growth in its credit card business. This segment grew because consumers still spend money. Although some risks exist, the bank remains very stable.

Citigroup Strategic Transformation

Citigroup is currently undergoing a massive change. CEO Jane Fraser leads this new strategy. Their US bank earnings show the start of this shift. Specifically, the bank is cutting many jobs. This is because they want a simpler structure. Therefore, they are exiting several global markets. This allows them to focus on high-profit areas. For instance, they like wealth management and services. However, restructuring costs money in the short term. Consequently, their net income saw some one-time hits. Nevertheless, the core business remains quite healthy. Because they simplified, they can react faster to trends. Similarly, their corporate clients still need their global network. This provides a steady stream of fee income.

Net Interest Income Trends

Net interest income is a vital metric for all lenders. It measures the gap between interest earned and paid. Currently, this gap is changing for many firms. Because deposit costs are rising, margins are shrinking. However, the total volume of loans remains high. Therefore, US bank earnings stay resilient for now. Specifically, banks must pay more to keep customer deposits. This is because customers want higher yields on their cash. Consequently, banks compete harder for every dollar. In addition, the Federal Reserve plays a big role here. If rates fall, these margins might change again. Therefore, bank stocks can be very volatile. Most banks expect NII to drop slightly this year.

Investment Banking Recovery Status

The investment banking world is finally waking up. For two years, deals were very slow. However, recent US bank earnings show a change. Specifically, many companies want to go public now. Therefore, equity underwriting fees are rising quickly. In addition, corporate debt sales are also increasing. Because rates have stabilized, firms feel more confident. Consequently, banks like Goldman Sachs and Morgan Stanley benefit. JPMorgan and Citigroup also see more activity here. This fee income is vital for high returns. Moreover, it does not require much capital. As a result, it boosts the return on equity. This makes investors very happy about the sector.

State of the American Consumer

The health of the consumer drives US bank earnings results. Currently, people still have jobs and spend money. However, credit card balances are starting to rise. Consequently, some banks are setting aside more money for losses. This is because they expect more defaults soon. Specifically, lower-income households feel the most stress. Therefore, banks watch spending patterns very closely. Nevertheless, most customers still pay their bills on time. As a result, the credit quality remains fairly good. In addition, wage growth helps people handle their debt. Therefore, the economy might avoid a deep recession. Banks remain ready for any sudden changes.

Bank Performance Comparison Table

| Bank Name | Net Income Trend | Key Strength | Main Challenge |

|---|---|---|---|

| JPMorgan | Growing | Market Share | Regulation |

| Wells Fargo | Stable | Mortgage Base | Asset Cap |

| Citigroup | Mixed | Global Services | Restructuring |

| Bank of America | Steady | Consumer Scale | Bond Portfolio |

Future Outlook and Risks

The future for US bank earnings looks quite complex. First, the path of interest rates is uncertain. If rates stay high, loan demand might fall. However, if rates drop too fast, margins will suffer. Therefore, banks must balance these two risks carefully. Specifically, they focus on diverse income streams now. For example, wealth management provides steady fees. Moreover, digital banking reduces long-term costs. Consequently, big banks might become even more profitable. Nevertheless, political risks are also present this year. New laws could change how banks charge fees. As a result, the industry must remain very agile.

Commercial real estate is another big worry for banks. Many office buildings have few tenants now. Therefore, the value of these buildings is falling. Because of this, banks might face losses on loans. However, large banks have very little exposure here. Specifically, they focus on high-quality properties and big firms. Consequently, the risk is higher for smaller regional banks. Nevertheless, the whole sector watches these trends. In addition, banks are using AI to find risks. This helps them avoid bad loans before they happen. Therefore, technology is a key part of their future.

Final Summary of Banking Trends

In conclusion, US bank earnings show a strong sector. Big banks continue to make large profits today. However, they face a changing economic landscape now. Specifically, higher costs and new rules create hurdles. Therefore, banks must innovate to stay ahead of others. We see a clear focus on efficiency and tech. Because of this, the industry remains a pillar of strength. Investors should watch interest rates and consumer debt. These factors will decide the next wave of results. Consequently, the banking story is far from over. It will continue to guide the global markets. As a result, staying informed is very important for all.