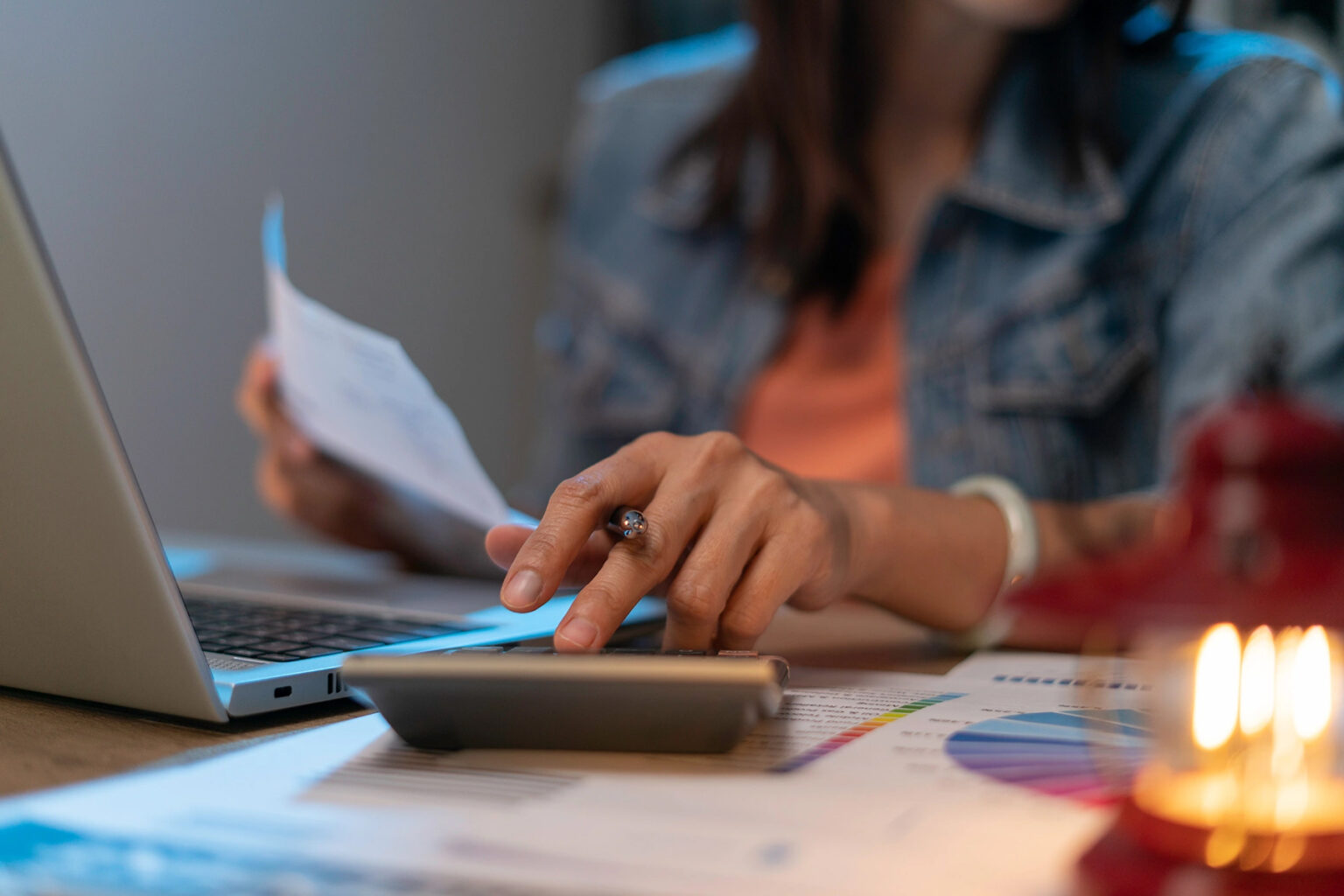

Influencers Urged to Pay Taxes

Avoiding Hefty Penalties

Thailand’s Revenue Department is calling on influencers to accurately report their income to avoid severe fines and interest, effective June 2025. With many unaware of tax obligations or deliberately evading them, the department is intensifying efforts to ensure compliance among the country’s 2 million influencers.

Strict Penalties for Tax Evasion

Fines and Interest Add Up

Director-General Pinsai Suraswadi warned that tax evasion incurs a fine double the unpaid tax if no return is filed, or equal to the underpaid amount for incomplete filings. Additionally, a 1.5% monthly interest surcharge, capped at 18% annually, significantly increases the financial burden for non-compliant influencers in 2025.

Costly Consequences of Non-Payment

Examples of Tax Liabilities

For instance, an unpaid tax of 10,000 baht could balloon to 40,000 baht with penalties and interest, while a 1 million baht tax debt could reach 4 million baht. The longer taxes remain unpaid, the higher the cost, making timely compliance critical for influencers in Thailand in 2025.

Potential Penalty Reductions

Incentives for Voluntary Compliance

Tax officers may reduce penalties by 25% to 50% for influencers