Table of Contents

- Introduction to Social Security Changes

- The Current Trust Fund Status

- Recent COLA and Tax Shifts

- Demographic Shifts and Challenges

- Future Financial Projections

- Proposed Policy Fixes

- Planning for Your Future

- Common Questions

Introduction to Social Security Changes

Social Security changes are happening now. These shifts affect millions of people. You must know how they work. Consequently, your retirement plans may need to change soon.

The system faces a big cash gap. Many seniors rely on these checks. However, the math does not look good. Therefore, we must look at the facts. This guide explains the new rules for you.

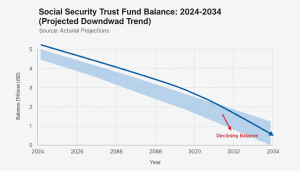

The Current Trust Fund Status

The trust fund holds the money for benefits. But this fund is shrinking fast. In addition, more people are retiring every day. This puts a lot of stress on the system.

Reports show the fund could run out soon. Specifically, this might happen by the year 2034. Because of this, benefit cuts are a risk. Yet, the program will not disappear completely.

| Year | Fund Status | Impact |

|---|---|---|

| 2024 | Sufficient Cash | Full Benefits |

| 2029 | Declining Cash | Review Needed |

| 2034 | Depleted Fund | Possible Cuts |

Recent COLA and Tax Shifts

Cost of living shifts help seniors keep up. However, these shifts change every year. For example, the 2024 boost was small. Because inflation slowed down, the raise was less.

Tax limits are also moving up. Higher earners now pay more into the system. Therefore, the program gets some extra cash. But this may not be enough to fix the gap.

Next, we must look at how wages change. Wage growth helps the trust fund grow. Although wages are up, prices are also high. Consequently, many folks still feel the pinch.

Demographic Shifts and Challenges

Fewer workers now support each retiree. This ratio is a major problem. Because of this, the burden on young people grows. Therefore, the old system needs a new plan.

People also live much longer now. This means they collect checks for more years. Consequently, the total cost of benefits rises fast. This is why Social Security changes are so vital.

Future Financial Projections

Experts track the cash flow every month. However, the outlook remains quite grim. Unless Congress acts, the math will fail. Therefore, we expect new laws very soon.

The main fund covers old age benefits. But a second fund covers disability too. Both funds face long term risks now. Consequently, the whole system is under watch.

If the funds hit zero, cuts will occur. Specifically, checks might drop by twenty percent. Because this is a huge loss, leaders are worried. Yet, they have not found a fix yet.

Proposed Policy Fixes

Some leaders want to raise the retirement age. This would keep people working longer. However, many folks do not like this idea. Therefore, it is a hard choice for lawmakers.

Other plans suggest higher payroll tax rates. This would bring in more cash right away. In addition, some want to tax the very rich. But these ideas often lead to big debates.

Lastly, some suggest cutting benefits for high earners. This is called means testing. Because it is a big shift, it faces pushback. Yet, all options are on the table now.

Planning for Your Future

You should not rely only on Social Security. Instead, save money in your own accounts. For example, use a 401k or an IRA. Therefore, you will have a safety net.

Watch the news for Social Security changes. Knowledge is your best tool for success. Also, talk to a pro about your money. Consequently, you will feel more secure and ready.

Common Questions

Will Social Security go away soon? No, the system will still collect tax cash. However, the payout amounts may go down. Therefore, the program stays, but it might change.

When should I start taking my checks? If you wait, your monthly check grows. But if you need cash, you can start early. Consequently, the choice depends on your health and goals.

Does work affect my monthly benefit? Yes, if you are under the full age. Therefore, check the earnings test rules first. Because if you earn too much, they hold some cash.