Introduction to Danish Pension Fund Divestment

The news about the Danish Pension Fund Divestment is now very big. One large fund in Denmark plans to sell its US debt. This fund is called AkademikerPension. They will stop holding US Treasury bonds by the year 2026. This choice comes from deep concerns. These concerns involve both climate and politics. Therefore, the fund seeks to protect its long-term goals. This move marks a major shift in how funds think. It shows that green goals now lead high finance.

Table of Contents

- Introduction to Danish Pension Fund Divestment

- Who is AkademikerPension?

- Why Sell US Treasuries?

- The Focus on Climate Change

- Political Risks in the US

- Impact on the Global Market

- US Bonds vs. Green Alternatives

- Modern ESG Strategies

- Future Outlook for Divestment

- Frequently Asked Questions

Who is AkademikerPension?

AkademikerPension is a major fund for school and college staff. They manage billions of dollars for their members. These members expect the fund to be wise. Also, they want the fund to be ethical. The fund has high standards for its assets. Because of this, they look at more than just profit. They check if a country follows global climate rules. In the past, they have sold other assets too. They avoid firms that harm the planet or people. Now, they turn their focus to sovereign debt.

A History of Ethical Choices

This fund has a long track record of bold moves. First, they left coal and oil stocks behind. Next, they looked at firms that break human rights. They believe that bad ethics lead to bad returns. Consequently, they act fast to sell risky assets. This latest move is their biggest step yet. It sends a clear message to the whole world.

Why Sell US Treasuries?

The fund will stop buying US debt for several reasons. Primarily, they do not like the current US climate path. They feel the US does not meet the Paris Agreement goals. Furthermore, they see high risks in the US political scene. Debt is a tool that funds use for safety. However, if the issuer is not stable, the risk grows. Thus, they choose to move their cash elsewhere. They want to find assets with less political stress.

The Focus on Climate Change

Climate change is the top worry for this fund. They want to reach net zero emissions soon. Because the US is a big polluter, it poses a risk. Moreover, the fund thinks the US lags in green laws. Many European countries have much stricter rules. Therefore, the fund prefers to invest in those nations. They want to support states that fight for the planet. This aligns with the values of their members. It also protects the fund from future carbon taxes.

Political Risks in the US

Politics in the US are very tense right now. This tension creates doubt for many global buyers. For example, debates over the debt ceiling cause fear. In addition, shifts in power can change trade rules. The fund wants to avoid this kind of drama. They need assets that stay calm over many years. Since the US is split, the path is not clear. So, the fund looks for more stable places to put money.

Impact on the Global Market

When a fund sells US debt, the world watches closely. US Treasuries are usually the safest bet in the world. However, if more funds leave, the prices might drop. This could lead to higher rates for the US. But, one fund is small compared to the whole market. Still, the trend is what matters most here. If other EU funds follow, the impact will be huge. It might force the US to change its climate goals.

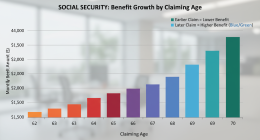

US Bonds vs. Green Alternatives

Here is a look at how US bonds compare to green options. This helps us see why the fund is shifting.

| Feature | US Treasury Bonds | European Green Bonds |

|---|---|---|

| Climate Rating | Low to Mid | Very High |

| Risk Level | Low | Low |

| Political Stability | Moderate | High |

| Future Growth | Stable | Rising |

Modern ESG Strategies

ESG stands for Environment, Social, and Governance. These three pillars guide modern funds today. The Danish Pension Fund Divestment is a core ESG move. It shows that social goals are as vital as cash. First, funds look at carbon footprints. Second, they check how a country treats its people. Third, they look at the rule of law. If any pillar is weak, they might sell. This strategy helps to lower long-term risk. It also keeps the fund in good standing with the public.

Future Outlook for Divestment

Will other pension funds do the same thing soon? Many experts think that they might. Europe is leading the way in green finance. Therefore, more funds will check their US holdings. If the US does not pass new green laws, it may lose more fans. However, the US is still a very large economy. Many people will still buy their debt for safety. But the growth of green bonds is very fast. Soon, they might be the top choice for all. We expect more news on this in the next year.

Frequently Asked Questions

Is the US debt still safe?

Yes, most experts still think it is very safe. The risk is not about default yet. Instead, the risk is about poor climate scores. For some funds, a poor score means they must sell.

When will the sale be done?

The fund plans to finish the sale by 2026. This gives them time to find new assets. It also helps them avoid market shocks.

Where will the money go?

Most of the cash will go into green assets. This includes wind farms and solar parks. It also includes bonds from countries with better climate laws.

Conclusion

The Danish Pension Fund Divestment is a major event. It shows that climate change is now a financial risk. AkademikerPension is leading this new way of thinking. They want to keep their money safe and clean. While the US is a big market, its path is uncertain. Thus, the fund moves toward greener and more stable shores. This choice will likely shape how other funds act. In the end, it is a win for the planet and the members. The world of finance is changing fast. We must watch these shifts to stay ahead.